Smartcards for CFA Level1

*Bestselling Smartcards now for the CFA® Exam*

Pass rate for CFA® Level I is 38% (Source: CFA® Institute 2013 data)!

Created by expert Tutors, Smartcards for CFA® Level I will help you succeed.

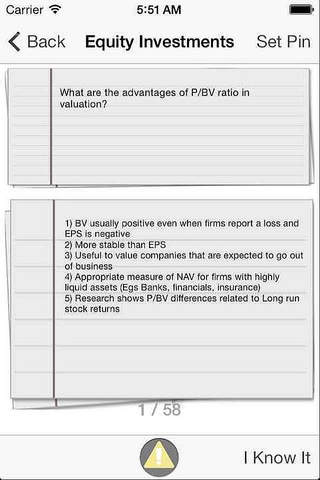

Smartcards are the next level of flashcards that adapt to your learning. Pin those cards you want to revisit and separate cards you are familiar with.

Over 1000 Essential facts for CFA® Level 1 including

Corporate Finance

Capital Budgeting

Cost of Capital

Working Capital Management

Financial Statement Analysis

Corporate Governance

Portfolio Management

The Asset Allocation Decision

An Introduction to Portfolio Management

An Introduction to Asset Pricing Models

Equity Investments

Organization and Functioning of Securities Markets

Security Market Indexes

Efficient Capital Markets

Market Efficiency and Anomalies

An Introduction to Security Valuation

Industry Analysis

Company Analysis and Stock Valuation

Introduction to Price Multiples

Fixed Income

Features of Debt Securities

Risks Associated with Investing in Bonds

Overview of Bond Sectors and Instruments

Understanding Yield Spreads

Introduction to the Valuation of Debt Securities

Yield Measures, Spot Rates and Forward Rates

Introduction to the Measurement of Interest Rate Risk

Alternative Investments

Alternative Investments

Investing in Commodities

Derivatives

Derivative Markets and Instruments

Forward Markets and Contracts

Futures Markets and Contracts

Options Markets and Contracts

Swap Markets and Contracts

Risk Management Applications of Option Strategies

Ethics

Code of Ethics and Standards of Professional Conduct

Guidance for Standards I-VII

Introduction to the Global Investment Performance Standards (GIPS)

Global Investment Performance Standards (GIPS)

Financial Reporting and Analysis

Financial Statement Analysis: An Introduction

Financial Reporting Mechanics

Financial Reporting Standards

Understanding the Income Statement

Understanding the Balance Sheet

Understanding the Cash Flow Statement

Financial Analysis Techniques

Inventories

Long-Lived Assets

Income Taxes

Long-Term Liabilities and Leases

Financial Reporting Quality: Red Flags and Accounting Warning Signs

Accounting Shenanigans on the Cash Flow Statement

Financial Statement Analysis: Applications

International Standards Convergence

Economics

Elasticity

Efficiency and Equity

Markets in Action

Organizing Production

Output and Costs

Perfect Competition

Monopoly

Monopolistic Competition and Oligopoly

Markets for Factors of Production

Monitoring Jobs and the Price Level

Aggregate Supply and Aggregate Demand

Money, price level and inflation

U.S Inflation, Unemployment and Business cycles

Fiscal Policy

Monetary Policy

An Overview of Central Banks

Quantitative Methods

The Time Value of Money

Discounted Cash Flow Applications

Statistical Concepts and Market Returns

Probability Concepts

Common Probability Distributions

Sampling and Estimation

Hypothesis Testing

Technical Analysis

* Includes charts and Figures

CFA Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by Hue Medscience. CFA Institute, CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.